WCA calculator shows how little people get from workers’ compensation under 2011 legislative amendments.

The problem is that insurance companies make this calculation and it does not matter whether you have actually returned to work. Vocational experts say jobs are available but you are not trying hard enough.

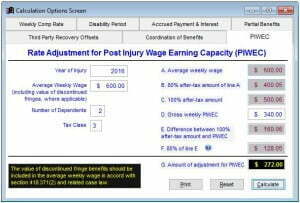

It is hard enough supporting a family on just 80% of wages. Click on the image for a sample PIWEC calculation and see why it devastates Michigan families.

Sample Calculation

Ricky Schneider works as machine operator and earns $15.00 per hour. He suffers a herniated disc in his back while lifting a 100 pound metal object. He must undergo a lumbar surgery and is limited to a sit-down job for the next 6 months.

His employer does not offer this type of employment and submits a claim to its insurance company. Wage loss benefits should equal 80% of his after-tax average weekly wage or $400.05 per week.

The insurance company decides to hire a vocational expert to perform a labor market survey. It is concluded that he could get a minimum wage job paying $8.50 per hour. His new weekly compensation rate will be $128.05 regardless of whether he actually finds new employment.

Michigan Workers Comp Lawyers never charges a fee to evaluate a potential case. Our law firm has represented injured and disabled workers exclusively for more than 35 years. Call (855) 221-2667 for a free consultation today.

Related information: